Commission-Based Compensation: Why It May Be Right for Your Startup

To some, starting a business may seem like the happy ever after cue before the credits roll, but that’s far from reality. Putting up that “open for business” signage is just breaking the ground; it signals the beginning of a tedious process of working your way up into the market.

Whatever your business may be, you can’t do things alone. The first thing that you need to do is hire people. However, with the impending payroll costs which your tight startup budget cannot cover, you might think twice and end up hogging all the work, and take everything on as a one-man team. But that is only so, when you’re planning on only recruiting salaried workers.

Payment by salary is a common compensation structure used by established companies, but this may not be the wise option for your startup, as you run the risk of having more cash outflows than profits.

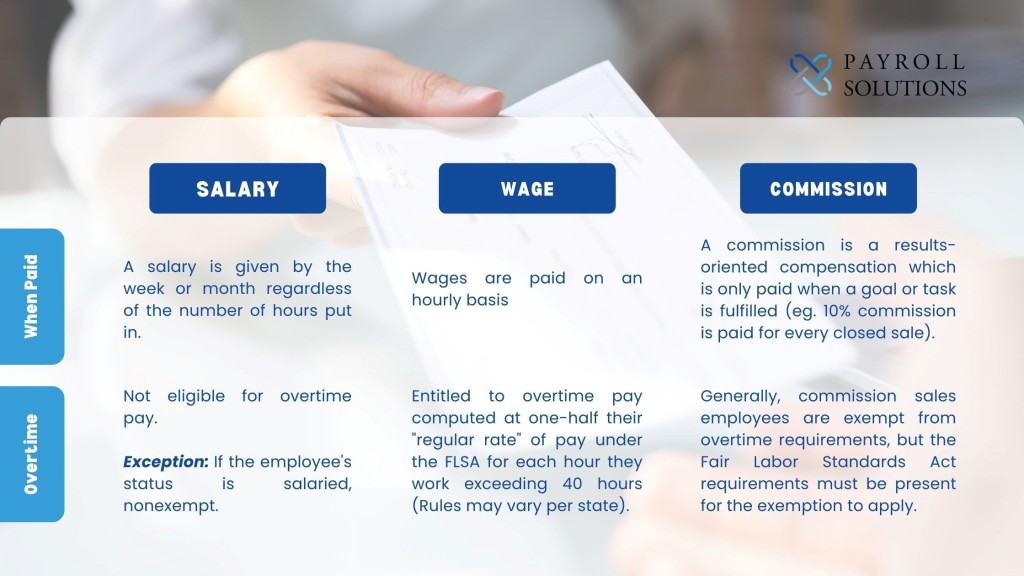

Let’s take a look at the different types of compensation:

Why Commission-Based Pay May Be Perfect for Startups

The early stages of your business mean inconsistent revenue streams and insufficient payroll budget to compete in the labor market. Opting for a commission-based compensation, remedies and counters these with the following benefits:

Since the payment of commission is results-oriented, you won’t have to worry about any disparity between your payroll costs and the revenue brought in by your employees.

As a startup, you don’t necessarily have the budget to offer competitive salary packages, but luckily, compensation is not the main and only factor that attracts applicants nowadays. There’s also work flexibility. In a survey, 87% said that they’d take the opportunity to work when, where, and how they’d like to.

Commission-based employees are granted this perk because they are not paid by the hour, weekly, or monthly, but by accomplishing a set goal like closing a sale. Hence, the number of hours or days they spend on work doesn’t matter as long as they can deliver results.

The amount of commission that employees get depends on how hard they work. Hence, they’re more inclined to run the extra mile to bring in more revenue because that way, they can earn more.

Another valuable asset that you can save on paying by commission, is your time. Assuming that you haven’t invested in payroll automation yet, you’ll most likely spend around 16 hours a month running manual payroll, including 7 minutes per time card.

By hiring commissioned employees, you get to keep these 16 hours because what you’ll be tracking is performance and output, not time.

When It Is Not for You

There are things that must be considered before choosing a compensation structure, such as the nature of your business, your goals, and how you want to schedule your employees.

Commission-based pay typically applies to expansion and sales oriented business goals and this setup entails schedule flexibility, so it may not work for a company in the hospitality and restaurant industry where employees work in shifts and are paid by the hour.

Pay Rules for Commission-Based Compensation

Before creating your pay structure, here’s what you should know and follow if you’re planning to adopt a commission-based compensation.

- Commission sales employees are not entitled to overtime pay.

For the overtime exemption to apply, the following requirements under the Fair Labor Standards Act must be present:

- The employee must be employed by a retail or service establishment;

- His/her regular rate of pay must exceed one and one-half times the applicable minimum wage for every hour worked in a workweek, in which overtime hours are worked; and

- More than half the employee’s total earnings in a representative period must consist of commissions.

Otherwise, overtime pay must be granted for hours worked beyond 40 hours in a workweek.

- You are still required to withhold payroll and federal income taxes on commissions.

Payroll taxes on commissions are withheld similarly to regular wages. This involves withholding flat rates of 6.2% for Social Security and 1.45% for Medicare (FICA taxes).

Meanwhile, if you are paying commissions on top of regular wages, there are different ways in which you can withhold federal income taxes on these commissions as supplemental income.

- Percentage Method

Under this method, taxes on the employee’s regular wages and commissions are withheld separately, with taxes on the latter withheld at a flat rate of 22%.

- Aggregate Method

In contrast, the aggregate method requires you to combine regular wages and commission income. Then, you need to look at your employee’s Form W-4 and cross-reference it with the income tax withholding tables in IRS Publication 15 to find the total withholding amount. Thereafter, look for the tax amount for the regular income and subtract it from the total withholding amount to get the amount of tax withholding on the commission income.

The said methods are applicable to supplemental income not exceeding $1 million per calendar year. For employees earning more than such amount in commissions, you must withhold an additional 37% from the amount that exceeds $1 million.

- You are mandated by law to pay all commissions due upon termination, cancellation or nonrenewal of the contract.

Under Wisconsin law, independent sales representatives are granted protection and given the right to claim all commissions due to them at the time of termination, cancellation or nonrenewal of the contract between them and their principal. Principals who fail to comply with said provision shall be liable for the unpaid commissions and damages of up to 200% of such unpaid commissions.

A commission-based compensation, whether as a standalone or supplemental payment, is more complex than a salary and hourly pay structure. Opting for this setup, although beneficial for a startup company, entails a lot of strategy and keeping up with applicable federal and state laws and regulations.

Payroll Solutions, an affiliate of the MBE Family of Companies, offers its clients not only payroll services, but also access to accountants and business tax professionals and resources. Talk to us today to get started!